Why Economic Systems Matter

In the realm of multi-chain ecosystems, the design of economic systems plays a crucial role in ensuring cohesion among various participants. To illustrate this, consider the experiences of two notable examples: Cosmos and Ethereum.

Cosmos initially envisioned the Cosmos Hub (ATOM) as the central pillar of its ecosystem, offering security and routing liquidity between chains. However, this vision fell short as the Hub failed to deliver significant benefits to other Cosmos chains. This resulted in fragmentation and limited adoption of ATOM, undermining its role as a unifying asset. Clearly, this approach did not achieve the desired outcome.

Ethereum, in contrast, has succeeded in embedding ETH as the core asset across its multi-chain world. Despite the proliferation of Layer 2 solutions, ETH remains central to gas fees, liquidity, and collateral, effectively establishing it as the “money” of the Ethereum ecosystem. This role has been pivotal in driving ETH’s value and solidifying its importance.

Expanding Blockspace and Driving Value

Initia specializes in providing vast amounts of blockspace, offering nearly limitless, customizable, and flexible Layer 2 solutions compatible with any VM. As data availability (DA) costs approach zero, traditional mechanisms like gas fees and token burns become less significant in driving value.

Instead of focusing solely on the supply side, Initia prioritizes shifting the demand curve. By creating genuine utility and use cases, Initia aims to enhance the ecosystem’s value—much like Ethereum has with ETH.

The goal is to establish a framework that positions INIT as the central asset uniting various domains within Initia’s multi-chain ecosystem. By distributing INIT widely and integrating it across all Layer 2 solutions, Initia aims to make INIT the standard asset, driving demand and creating meaningful use-cases across the network.

What Does Alignment Mean?

In a multi-chain ecosystem with numerous interconnected rollups, aligning incentives is essential for cohesion. It’s about ensuring all participants are moving in the same direction.

Initia achieves this alignment through three key aspects:

-

Architectural Alignment

-

Every Minitia uses CosmosSDK, providing a unified infrastructure for communication.

-

Initia’s Layer 1 serves as the hub for liquidity, security, and asset fungibility.

-

-

Product Alignment

-

Consistent UI/UX across Minitias simplifies wallet connections and navigation.

-

Initia streamlines and abstracts modular complexities for a seamless user experience.

-

-

Economic Alignment

-

Drive convergence by integrating the INIT token across the ecosystem.

-

Ensure all participants have strong incentives to engage with and value INIT.

-

This unified approach ensures that all elements of Initia’s ecosystem work harmoniously.

The Initia Vested Interest Program (VIP)

The Initia Vested Interest Program (VIP) is crafted to align the interests of users, developers, and Layer 2 solutions within the Initia ecosystem. By using Initia’s Layer 1 architecture and its native token, INIT, the VIP ensures that all participants have a stake in the success of INIT.

VIP manages INIT distribution to encourage active participation and integration of the token, driving economic activity and long-term commitment to Initia’s goals. It creates a supportive environment where L2 solutions can thrive and contribute to the overall ecosystem.

Unlike Cosmos and Ethereum, where chains often work in isolation, VIP fosters collaboration by aligning incentives across Initia’s network. It motivates Minitias to add value, integrate the INIT token, and support the L1 infrastructure that funds L2 solutions. The program addresses common issues such as incentive misalignment and under-utilization of tokens, aiming to create a more unified and valuable ecosystem.

VIP Architecture

At network launch, a portion of the total INIT token supply, referred to as R, will be allocated as rewards for the VIP program. These rewards are distributed periodically over several years.

Eligibility and Distribution:

-

Minitia Eligibility: Minitias must be whitelisted by the Initia L1 governance through an on-chain proposal to qualify for VIP rewards

-

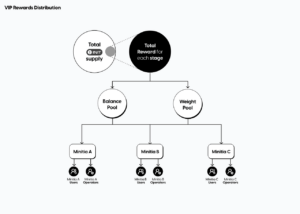

Rewards Distribution: At each distribution stage t, the total VIP rewards Rt are divided among all whitelisted minitias. This distribution involves:

– Allocating rewards to the Balance Pool RB and the Weight Pool RW.

– Distributing rewards from these pools to minitias.

– Further distributing rewards to minitia users and operators.

Rewards Allocation:

-

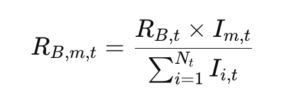

Balance Pool:

Rewards are based on the amount of INIT tokens locked by each minitia. The formula is:

Where:

-

RB,t is the total rewards from the Balance Pool for the stage.

-

Im,tIm,t is the amount of INIT tokens locked by minitia m during the stage.

-

NtNt is the total number of minitias in the stage.

-

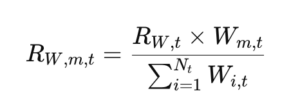

Weight Pool:

Rewards are distributed based on the weight of each minitia, determined through a gauge weight voting process. The formula is:

where:

-

RW,t is the total rewards from the Weight Pool for the stage.

-

Wm,tWm,t is the weight of minitia m during the stage.

-

NtNt is the total number of minitias in the stage.

Distribution to Users and Operators:

-

Users: Rewards are distributed based on a scoring method determined by the minitia.

-

The scoring method could be based on factors such as:

-

Number of transactions a user makes on the minitia.

-

Value of assets a user borrows.

-

Trading volume or liquidity provided by the user.

-

-

Users’ rewards are calculated as:

-

-

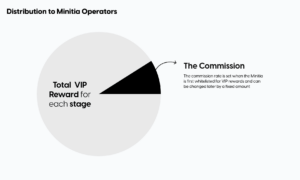

Operators: Operators can receive a portion of the rewards based on a set commission rate \( c_m \):

Rewards Vesting:

-

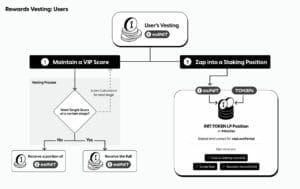

Users: Rewards are initially non-transferable and can be vested in two ways:

-

Maintaining a VIP Score: Rewards vest over a series of periods if the user maintains a required score.

-

Zapping into a Staking Position: Users can convert escrowed INIT tokens into a staked INIT:TOKEN LP position, which is locked for a period.

-

-

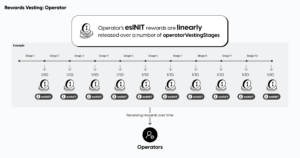

Operators: Rewards are vested linearly over a specified number of stages. For example, if the vesting period is 10 stages, the operator receives \(\frac{1}{10}\) of their esINIT at each stage.

This simplified explanation provides an overview of how the VIP rewards system operates, from eligibility to distribution and vesting.

VIP Gauge Voting

To allocate rewards from the Weight Pool to each minitia, a gauge weight voting process is used. This process, similar to Curve Finance’s approach, involves two main steps:

-

Voting Power Snapshot Submission

-

Gauge Voting

Voting Power Snapshot Submission

Before voting begins, a designated party, known as the Snapshot Submitter, takes a snapshot of the voting power of all stakers on the Initia L1 blockchain at a specific block height. This snapshot is then submitted for use in the gauge voting process.

Gauge Voting

After the snapshot is taken, gauge voting starts. Each VIP-whitelisted minitia has a “gauge” that determines its share of the Weight Pool rewards. Stakers use their voting power to influence these gauges, either by concentrating their votes on one minitia or distributing them among several.

Gauge voting takes place on Initia L1.

Challenging Snapshot Submissions

If a snapshot submission is incorrect or suspected of being malicious, it can be challenged. To challenge a snapshot, submitters must propose a new snapshot with the following details:

-

Merkle Root: The root of the correct snapshot’s Merkle tree

-

API URI: An API endpoint to validate the new Merkle Root

-

Snapshot Height: The block height of the snapshot, which must match the original

-

Challenge Deposit: A deposit in INIT tokens to initiate the challenge (refunded if successful)

Challenge Proposal Timing: Challenges can be submitted anytime during the cycle after the original snapshot submission, provided there’s enough time for voting on the challenge. For example, if the cycle duration is 10 units and the snapshot is submitted at t = 1, a challenge can be proposed between t = 1 and t = 7.

Voting on Challenge Proposals

Once a challenge proposal is submitted, users can vote on it. Eligible voters are those who participated in gauge voting during the previous cycle. Their voting power for the challenge is equal to the amount used in the previous gauge voting.

For example, if a user had 100 voting power but used only 50 for gauge voting, their challenge voting power is 50.

If the “Yes” votes reach the required quorum, the challenge is successful, leading to:

-

Replacement of the original Snapshot Submitter with the challenger

-

Refund of the INIT deposit to the challenger

VIP Scoring

VIP Scoring distributes esINIT rewards based on user activity in each minitia. Here’s a simplified breakdown:

Whitelisting

– Minatias and their users must be whitelisted through a governance proposal on Initia L1 to qualify for VIP rewards.

Scoring Epochs

– Rewards are distributed on a regular basis, called epochs. Each epoch includes the following steps:

Scoring

Minatia teams score users based on their activity using a

vip_score contract or module. The scoring criteria are set by each minitia.The minitia operator registers their account with the

vip_score contract to manage user scores. Only the registered deployer can update scores until changes are made.After scoring, the results are finalized by calling a function on the

vip_score contract.Snapshotting

The VIP Agent, chosen by Initia L1 governance, takes and submits a snapshot of all scores, storing them in the Initia L1 VIP module. After snapshotting, esINIT rewards are distributed to users.

Claiming

Users can claim their distributed rewards after the snapshot is complete.

Conclusion

Economic systems are vital for the success of multi-chain ecosystems, as demonstrated by the contrasting experiences of Cosmos and Ethereum. Cosmos’ approach fell short of creating a unified asset, while Ethereum effectively established ETH as the central asset within its ecosystem.

Initia’s focus on providing extensive blockspace and leveraging the INIT token aims to replicate Ethereum’s success by creating a central asset that drives value and cohesion. Through architectural, product, and economic alignment, Initia seeks to ensure a seamless, unified experience across its multi-chain network. The Initia Vested Interest Program (VIP) is designed to foster collaboration and incentivize participation by integrating the INIT token, thereby addressing common issues and driving long-term commitment within the ecosystem.