What is CasperSwap?

Casperswap is the first automated market-making decentralized exchange on the Casper Network. It is an automated liquidity protocol powered by a constant product formula and implemented as a system of non-upgradeable smart-contracts on the Casper network.

It obviates the need for trusted intermediaries, prioritizing decentralization, censorship resistance, and security. Casperswap is open-source software licensed under GPL.

Tìm hiểu thêm về Casper Network là gì?

How Casperswap Works?

CasperSwap provides an open, transparent, and efficient solution for protocols to incentivize liquidity for their own use case, for liquidity providers to earn fees and competitive rewards, and for traders to swap assets efficiently.

At its core, CasperSwap features a CasperSwap AMM and novel Tokenomics with competitive LP incentives.

CasperSwap AMM

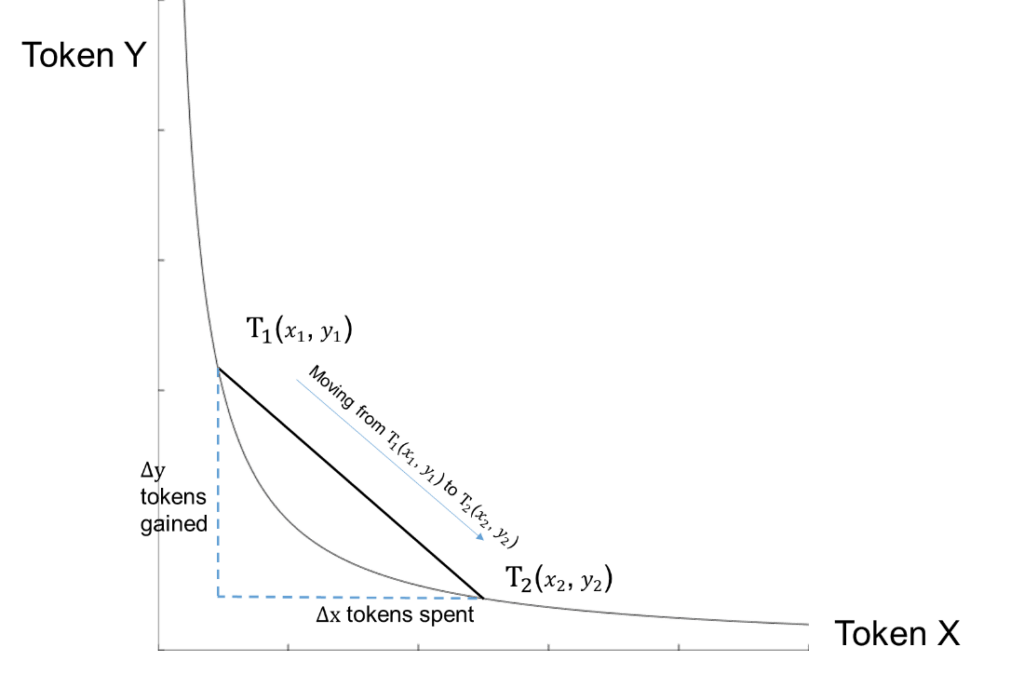

CasperSwap chose the Uniswap v2 AMM design (xy=k) because it allows long tail assets to have liquid functioning markets while permitting LPs to earn yield from trading activity. In the xy=k design, the two tokens in the liquidity pool are priced relative to each other. When the price of token A falls in price relative to token B, the protocol automatically buys more of token A by reducing exposure to token B.

The trader is effectively trading with the liquidity pool rather than other traders as seen in a traditional order book exchange. There is ongoing research that analyzes impermanent loss (IL), or when an LP withdraws a smaller dollar value of the pooled tokens compared to the time of the deposit. When deciding which exchange design we would implement, we considered IL, but we also believe that democratizing liquidity provision is an essential feature to attract capital in search of yield. We are also optimistic that other protocols will build on top of CasperSwap to tackle IL, liquidity management, and much more according to the needs of LPs. Our incentive structure is designed to factor in IL for volatile pairs and target an APY that is competitive with the APYs of existing exchanges. CasperSwap intends to be the base layer infrastructure for future money legos to build on in order to grow opportunities for LPs to efficiently manage and earn yield.

How Do Users Benefit from CasperSwap?

Liquidity Providers

LPs enjoy the chance to diversify yield-generating positions on CasperSwap. Besides the trading fees captured from the active users in Casper Network and competitive LP incentive, it provides an infrastructure for the future money lego to build on top of it and, thus, new earning opportunities for LPs.

Traders

As the largest liquidity hub on Casper, CasperSwap benefits both retail and institutional traders looking to make swaps at scale in two aspects: better prices and low fees (.25% + .01% to .05% treasury fee).

DAO Treasuries / Other Projects

CasperSwap is the first DEX to support DAO Treasuries on Casper. It provides a solution for token projects and DAO treasuries on Casper Network to efficiently direct and incentivize liquidity through voting and bribing.

Other DeFi Projects

Other projects also benefit from Casep Swap’s deep liquidity. For example, before a money market can function properly, there must be a decentralized exchange that can facilitate large-scale liquidations without massive price impact. Otherwise, liquidators would not be incentivized to proceed, and the money market will be left with bad debt. CasperSwap truly is the base layer for DeFi on Casper.

CasperSwap Tokenomics

The Native Token: CST

The $CST token is a utility token for the CasperSwap users to stake, boost, and vote. It is also used to incentivize early adopters of CasperSwap.

The stake, boost, and vote model will follow the classic curve ve-model and will be released soon.

At launch, the ve-model is expected to onboard new token projects to the CasperSwap ecosystem to participate in the bribing and liquidity incentivization.

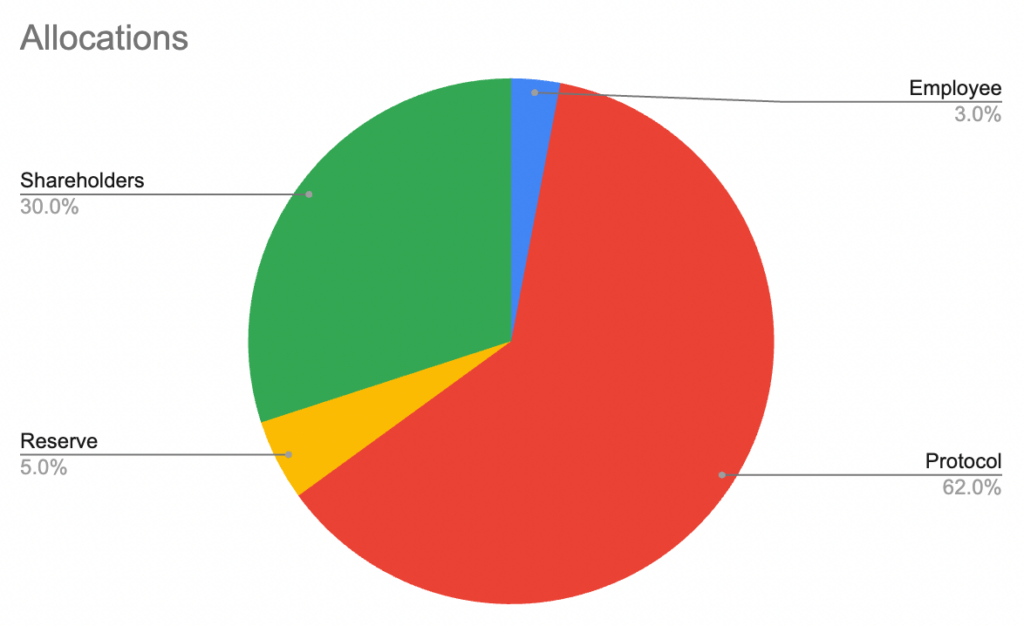

Token Distribution

Total Token Supply: 1,744,607,990

- Shareholders 30%

- Employee 3%

- Reserve: 5%

- Protocol Community Fund 62% (LP Program 60% + Other Community Grants 2%)

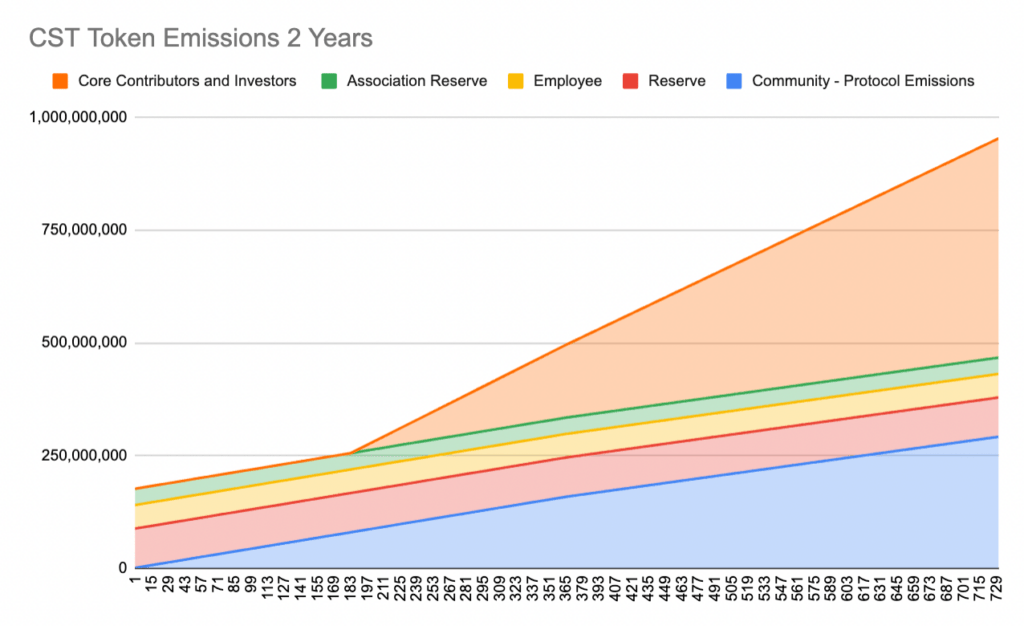

Schedule

Unlock start date: October 10, 2023

CST Token Emission schedule 2 Years

Find out the details of the unlock schedule on: CasperSwap Tokenomics

CasperSwap LP Incentive Program

The CasperSwap LP Incentive Program is designed to reward early adopters and liquidity providers of CasperSwap.

The initial rewards at the launch of the LP incentive program will also include the CSPR rewards.

The launching rewards are distributed per gauge at the launch of the LP incentive program as of October 10, 2023:

- CST-WCSPR 606,859 CST + 33,348 WCSPR

- dBTC-WCSPR 606,859 CST + 33,348 WCSPR

- dETH-WCSPR 606,859 CST + 33,348 WCSPR

- dUSDC-WCSPR 606,859 CST + 33,348 WCSPR

- dUSDC-dUSDT 606,859 CST

- dUSDT-WCSPR 606,859 CST + 33,348 WCSPR

Conclusion

CasperSwap represents a significant advancement as the Casper Network’s first decentralized exchange, optimizing liquidity with its innovative AMM design and robust tokenomics. It serves as a vital platform for traders, liquidity providers, and DAO treasuries, driving forward the DeFi ecosystem on Casper. As it evolves, CasperSwap is set to be a cornerstone of DeFi innovation on the network.

About OriginStake

Originstake is your professional and trusted validator that assists you in your staking activities. We provide full support services, a reward management dashboard, rewards sharing, and much more!

With Originstake, staking is safe, profitable, and extremely cost-effective!